The once-in-a-decade shortage tide has quietly arrived in 2016, and the continuous fermentation reached its peak in 2017. The fundamental reason for the outbreak of the shortage tide lies in the periodic adjustment of the semiconductor industry and the increasing imbalance between supply and demand upstream and downstream. Capacity expansion will take some time, and the market gap is difficult to fill in short time, and 2018 shortage tide continues.

According to Steven Lustig in an article he wrote for Industry Week, it is a “Fabrication Shortage.”Following the recession that started in 2008, Steven says, “Suppliers were left with a lot of inventory when demand dried up, seemingly overnight. Those same suppliers have operated out of an abundance of caution ever since.” Suppliers were running leaner to cut costs, and as a result, when demand began to increase, they weren’t prepared for the surge.

What is the Cause for the Surge in Demand?

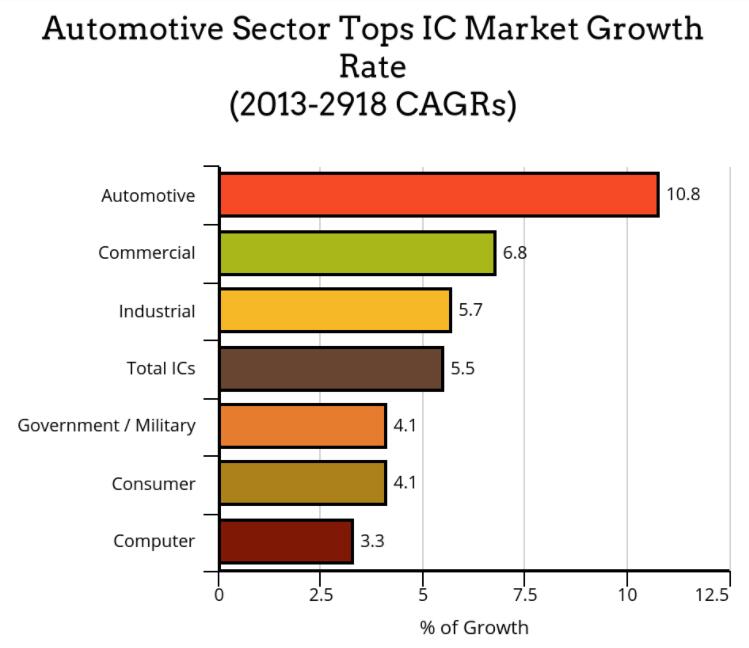

The higher demand stems from a global innovation boom, and an upward growth in key market segments, including Automotive, Industrial and Consumer sectors. Connected Gear is in everything we buy today. The trend towards smart devices is growing exponentially, and with it the need for more electronic components.

Chief among those components in high demand and low supply are MLCCs (Multi-Layer Ceramic Capacitors)

What is the Correlation Between the Innovation Boom & MLCCs?

The demand for these capacitors begins within two major market segments.

Automotive: The automotive segment is at the forefront of today’s higher demands. With the increase in Automated Driving Systems and Self Driving Vehicles, so follows the need for more specialized, automotive rated components. The past 5 years, in the UK alone, there has been a boost in demand for electric vehicles. According to an article on NextGreenCar.com, “new registrations of plug-in cars increased from 3,500 in 2013 to more than 160,000 by July 2018.” Neil Sharp of JJS Manufacturing writes, “The higher temperatures inside the control circuits of electric vehicles mean that traditional plastic film capacitors are no longer suitable… A specific type of ceramic capacitor technology is required to control the vehicle’s electronics.

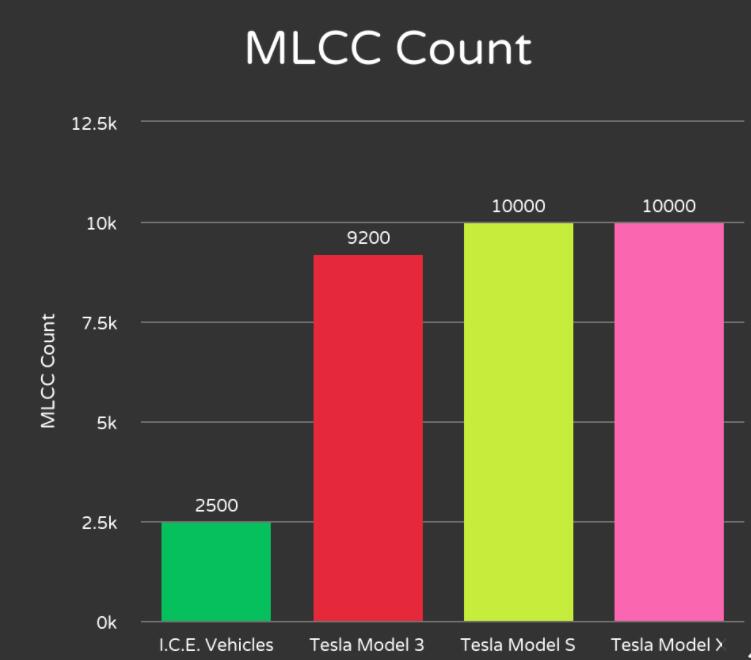

According to a Kemet report in February 2018, while the average vehicle may require approximately 2,500 MLCCs for its electronic systems, an EV (Electric Vehicle) requires in excess of 10,000 MLCCs for its more rigorously advanced systems.

The 2nd Major Market Segment depleting the MLCC stock is Consumer Products:

The other culprit behind this scramble for MLCCs comes from the Consumer market, where the demand for smarter, more connected products puts added pressure on an already weakened supply of electronic components.

We want smart homes, TVs, and Bluetooth speakers. We want on the go devices like smart phones, digital navigation systems, and more wearable tech like smart watches and even clothing. All these things added to our daily lives also adds to the demand on our supply chains.

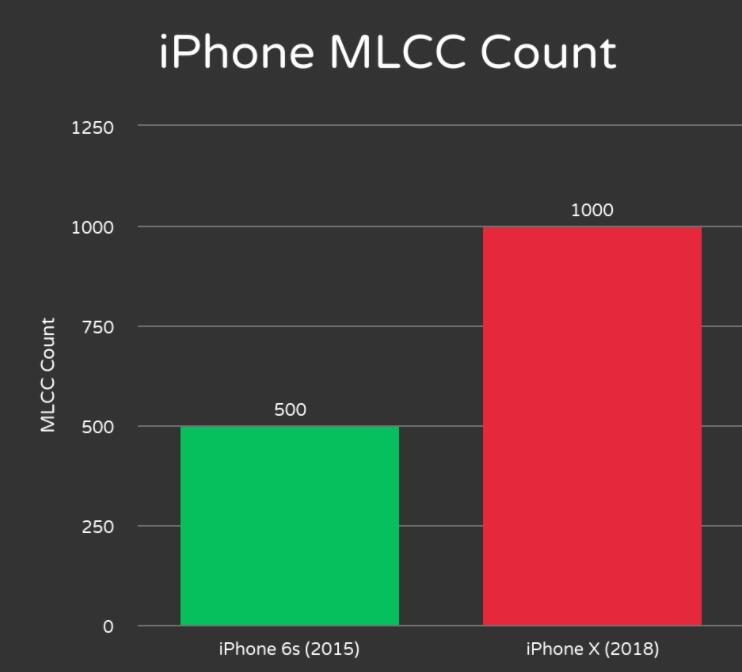

According to that same report by KEMET, the use of components in the Apple iPhone have doubled since the 6s was released in 2015. The latest model reportedly uses more than 1,000 MLCCs.

To get a better understanding of how much pressure that puts on the supply chain, in February of this year (2018), during their earnings report, Apple posted sales of 77.3 million iPhones. Multiply those sales by 1,000 MLCCs per unit and you start to see the overall effect of these increases.