An audit checklist designed to prevent counterfeit components from entering the aerospace industry’s supply chain was released in early September, with Mouser Electronics heading the list of authorized distributors approved under the mitigation framework.

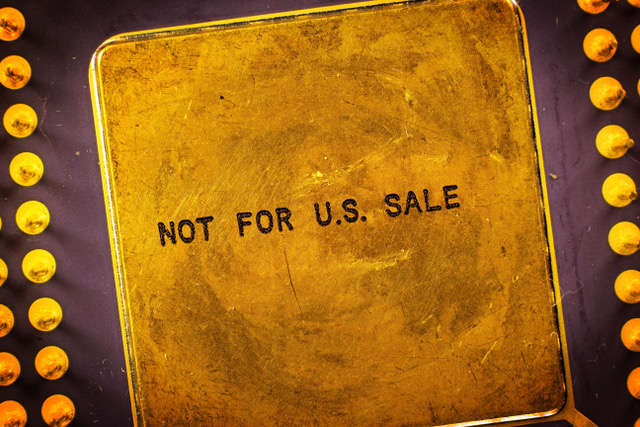

Meanwhile, a range of anti-counterfeiting technologies are emerging as fake chips continue to flood key industrial markets.

The Electronic Components Industry Association (ECIA) said the checklist, designated AC7403, provides a framework for auditing and certifying electronics distributors through the Performance Review Institute (PRI).

“The audit checklist verifies that there is a system in place which should prevent counterfeit parts from getting into the supply chain,” said Don Elario, ECIA’s vice president for industry practices.

The audit checklist also helps vendors comply with an industry standard anti-counterfeiting standard that requires distributors to have a counterfeit mitigation policy in place. Drafters of that standard along with PRI and aerospace manufacturers helped development the audit checklist.

The checklist was drafted by members of an aerospace industry initiative called the Counterfeit Avoidance Accreditation Program, of CAAP, along with other suppliers. CAAP “subscribers” are: Ball Aerospace, Boeing, GE, Honeywell, Lockheed Martin, Northrop Grumman, Rockwell Collins, UTC Aerospace Systems, Raytheon, and Rolls-Royce. The Defense Contract Management Agency also participated.

The audits performed by PRI are similar to an aerospace industry accreditation framework known as Nadcap used to gauge suppliers’ manufacturing processes, including steps like chemical processing, heat treating and non-destructive testing.

“CAAP is very similar to Nadcap in that it is an industry managed program,” added Jim Lewis, CAAP program manager. “The Nadcap model was used to develop the CAAP program.”

The rollout of the audit checklist coincides with what other industry groups report is a decline in the number of counterfeit and nonconforming parts. ERIA, which tracks supply chain issues, reported 771 suspect components last year. One possible explanation for last year’s marked decline could be fewer attempts to pass off fake parts or more sophisticated counterfeiting techniques, the industry group explained.

Still, the rise of global supply chains has made it harder for auditors to track down counterfeit components, placing the onus on manufacturers to work closely with suppliers to track components that end up in mission-critical systems.

“With the current supply constraints in the marketplace, it is even more important for customers to know that their distributor is meeting the AS6496 anti-counterfeit measures,” said Pete Shopp, Mouser’s vice president of global operations.

The industry group said Mouser is so far the only electronics vendor to be audited. PRI is currently reviewing the audit.

While the aerospace sector has taken the lead in efforts to keep fake components out of the supply chain, other sectors of the semiconductor industry are developing a range of anti-counterfeit technologies. Among them are so-called “item-level” RFID tracking along with authentication technologies such as holograms, watermarks, inks and dyes.

Meanwhile, conventional barcodes remain the leading packaging technology for tracking and tracing electronic components.

Demand for these anti-counterfeiting technologies is expected to skyrocket over the next several years as the number of counterfeit components grows. The industry watcher Research and Markets predicts the global anti-counterfeiting market will grow at an annual rate of more than 10 percent to $24.2 billion by 2020.